Remain Gatekeepers, Not Facilitators of Criminal Activities-Olukoyede Charges Banks’ Compliance Officers in South-East

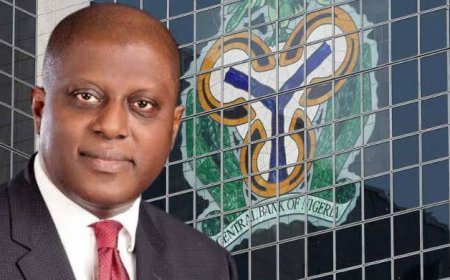

The Executive Chairman of the Economic and Financial Crimes Commission, EFCC, Mr. Ola Olukoyede has charged Banks’ Compliance Officers in the south-east to be professional in discharging their duties in order not to destroy the image of their banks and attract unnecessary regulatory sanctions, as they are regarded as the gatekeepers, not facilitators of criminal activities.

The Executive Chairman of the Economic and Financial Crimes Commission, EFCC, Mr. Ola Olukoyede has charged Banks’ Compliance Officers in the south-east to be professional in discharging their duties in order not to destroy the image of their banks and attract unnecessary regulatory sanctions, as they are regarded as the gatekeepers, not facilitators of criminal activities.

He gave this charge on Thursday, December 18, 2025 in Enugu, during a one-day sensitization programme, organized by the Enugu Zonal Directorate of the Commission for Banks’ Compliance Officers in the region.

While describing them as “the watchdog, those that should guide the bank and navigate operations of the bank to align with the anti-money laundering measures at the national levels”, Olukoyede, who was represented by the Zonal Director, Enugu Zonal Directorate of the Commission, Commander of the EFCC, CE Daniel Isei, said that compliance in the financial sector was a clear cut responsibility and it is incumbent on Compliance Officers to collaborate with the Commission especially in the area of responding promptly when necessary information is needed by investigators of the Commission.

“What we basically expect from you is that clear understanding of cooperation. A simple Letter of Investigation should be honoured; where information is required, it should be given quickly because a delay in giving this information is also stalling investigation”, he said. He warned that under his watch, the Directorate will not tolerate situations whereby certain individuals operate banking transactions on their accounts without the Bank Verification Number, BVN.

The anti-graft czar condemned the practice of some bankers who tip off their customers when the EFCC requests the bank to carry out a Place No Debit on the individual’s account. He described it as criminal and sabotage to the national security efforts. “You do not know the volume of information available to the investigator. To be safe, deal strictly with the information and back off because you don’t know if the said customer is flagged under the United Nations list, you don’t know if it is a request from the National Security Adviser, you don’t know the nature of the case. But for the fact that the man has a very huge deposit with your bank and you will go, what is the EFCC looking for now? This man is my prime customer. They want to start their “wahala” again and you will call the customer, ‘hello, EFCC sent a letter, what’s your problem with EFCC.’ We know all these things and it shouldn’t continue.” he said.

The EFCC Chairman commended the banks for sharing vital intelligence with the Commission and enjoined them to stay professional and avail the Commission with every necessary support it needs to achieve its mandates in the region.

He thereafter enjoined financial institutions in the south-east to take seriously their duties of conducting customer due diligence and Know Your Customer, as a way of strengthening their synergy with the Commission in ridding the region of corruption, economic and financial crimes.

What's Your Reaction?