EFCC Tackles Banks in N18.7billion Fraudulent Investment, Airline Discount Schemes

The Economic and Financial Crimes Commission, EFCC, has raised the alarm over the alleged negligence and compromise of banks and Fintechs in two major fraudulent schemes that have cost victims a total of N18, 739, 999, 027.35.

The Economic and Financial Crimes Commission, EFCC, has raised the alarm over the alleged negligence and compromise of banks and Fintechs in two major fraudulent schemes that have cost victims a total of N18, 739, 999, 027.35.

The alarm was raised in Abuja on Thursday, January 22, 2026 by the Director, Public Affairs of the Commission and the commander of the EFCC, Wilson Uwujaren while addressing the media on two separate schemes being employed by fraudsters to scam Nigerians.

According to him, one new generation bank and six Fintechs and Micro Finance Banks are aiding fraudsters in defrauding Nigerians through fraudulent schemes.

The first scheme involved airline discount fraud through which fraudsters lure their victims to lose their hard-earned money. “The modality of these fraudsters, according to him, “ involves a string of carefully devised airline discount information that any unsuspecting foreign traveler will fall for. What they do is to advertise a discount system in the purchase of flight tickets of a particular foreign carrier. The payment module is designed in such a way that their victims would be convinced that the payment is actually made into the account of the airline. No sooner the payment is made than the passenger's entire funds in his bank account are emptied”.

He disclosed that over 700 victims have fallen into the trap of fraudsters through the scheme with a total loss of N651, 097, 755.00 to them. Though the Commission succeeded in recovering and returning N33,628,000.00 to victims of the scam, Uwujaren cautioned Nigerians to be more vigilant as foreign actors involved in the scheme are converting their illicit sleaze into cryptocurrency and moving them into safer destinations through Bybit.

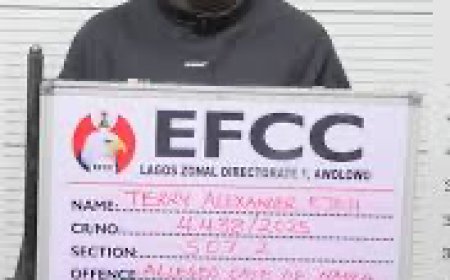

The second scheme, according to the EFCC’s Director, involved a company named Fred and Farid Investment Limited, simply called FF investment, which lured Nigerians into bogus investment arrangements.

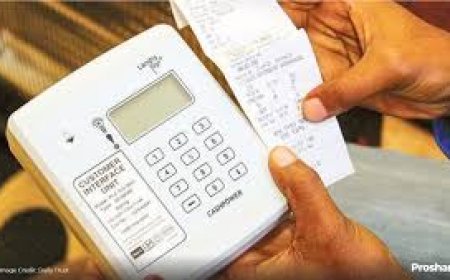

On the specific role of banks and Fintechs in the schemes, two other Directors of the EFCC, Abdulkarim Chukkol, Director of Investigations, Michael Wetcas, Acting Director, Abuja Zonal Directorate of the Commission, explained the compromise of the nation's financial space by some financial institutions. According to them, “a new generation bank and six Fintechs and Micro Finance Banks are involved in this. The financial institutions clearly compromised banking procedures and allowed the fraudsters to safely change their proceeds into digital assets and move into safe destinations”

“A total sum of N18, 739, 999, 027. 35k had been moved through our financial system without due diligence of customers by the banks. It is worrisome that investigations by the Commission showed that cryptocurrency transactions to the tune of N162 billion passed through a new generation bank without any due diligence. Investigations also showed that a single customer maintained 960 accounts in the new generation bank and all the accounts were used for fraudulent purposes”

The EFCC called on regulatory bodies to bring financial institutions to compulsory compliance with regulations in the areas of Know Your Customers, KYC, Customer Due Diligence, CDD, Suspicious Transaction Reports, STRs and others. The Commission charged regulatory bodies that Deposit Money Banks, Fintechs, Micro Finance Banks found to be aiding and abetting fraudsters should be suspended and referred to the EFCC for thorough investigation and possible prosecution. It also warned that negligence and failure to monitor suspicious and structured transactions by banks would no longer be allowed.

The Commission assured that it will continue its work against money laundering by fraudulent actors. Uwujaren also tasked financial institutions to firm up their operational dynamics and save the nation from leakages and compromises bleeding the economy.

What's Your Reaction?