New Telegraph Thursday Back Page of December 5, 2024

"...Collecting more taxes than is necessary is legalized robbery"- Calvin Coolidge

Whenever a National debate is ongoing in Nigeria, it would be difficult to enter the fray from a rational and patriotic point of view. In Nigeria, debates are usually pigeonholed into ethnic and/or religious and geopolitical slants, as is the case with the ongoing tax reform debate.

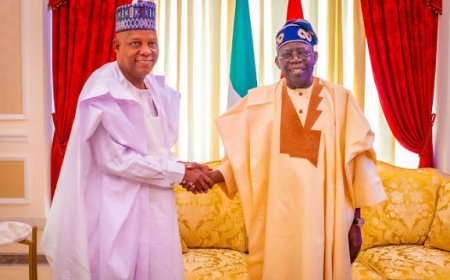

The ongoing brouhaha over tax reform, like every issue in Nigeria, has been muddled up; the main issue has taken backstage. The sentiments in it now drive the debate, and it’s difficult to join the debate without being identified as either pro-North or pro-Tinubu and his Lagos group.

NNPP Presidential Candidate in the 2023 election Rabiu Kwankwaso even tagged his understanding of the tax reform as the continuation of the colonization of the geopolitical North that began with Tinubu’s attempt to install an Emir in Kano state.

Reforms all over the world do not just come; they face enormous resistance, but when they survive the bashing, it’s usually for the good of society. What determines the survival of a reform anywhere depends on the motive of the person or group driving it. If the motive is seen as selfish and devious in handling, even the positive end of it will suffer. That appears to be the crux of the matter with the resistance to the Tax reform bills.

Recall that in September, President Tinubu sent four tax reform bills to the National Assembly: the Nigeria tax bill, the Joint Revenue Board Establishment Bill, the Nigeria Revenue Service, and the Nigeria Tax Administration bill.

The four bills are fallouts from the Presidential Committee on Fiscal Policy and Tax Reforms set up by the President in August 2023. The committee was chaired by a notable Lagos tax expert, Taiwo Oyedele.

If these four bills are turned into law at the National Assembly, it would lead to the repealing of at least eleven existing tax laws in Nigeria and it will bring them into one uniform law.

The President, by his argument, sees his new bills as pro-poor and pro-growth to the extent that it exempts anybody earning N800,000 or less from income tax and reduces the income tax from 30% to 25%, exempting small companies from paying income tax. But the hike in VAT from 7.5% to 15% appears to have taken away the gains from consumers.

But the question is, If the reform has all these positives why the resistance? The defiance against the tax reform has its origin in the electoral mandate of the President. It’s an indisputable fact that an Elected President in a democracy can rightly claim to have the mandate of the people. But to what extent can Bola Tinubu rely on his mandate? Even if the INEC and the judiciary gave legal authority to his mandate, to what extent is that to the larger population who were part of the electioneering and the eventual outcome?

Aside from the k-leg of his mandate due to the Electoral malfeasance recorded during the election, how enticing can Tinubu’s administrative style win sympathy for any of his policies? The decreed manner he removed the petrol subsidy soon after his swearing-in on May 29, 2023, had no input from the people. The government’s apparent indifference to the suffering populace arising from his harsh policies, the lavish public and private lifestyle of the regime operatives, and the prioritizing of grandiose projects ahead of what addresses the welfare of the ordinary people, among others, combine to de-market any policy of this government.

How on earth will Tinubu expect his tax reform to enjoy accolades with the frightening nepotism his regime is exhibiting, especially in the finance sector? The Chairman of the Presidential Advisory Committee that recommended the tax reform is Yoruba, the Chairman of the Federal Inland Revenue Service that will implement the reform is a Yoruba, the Governor of the Central Bank of Nigeria, CBN that will supervise the reform, is a Yoruba, ditto the Minister of Finance the custodian of all revenues also aYoruba, the blue Economy Minister also a Yoruba, the head of the main revenue collector, the Customs Service also a Yoruba etc. Nigerians, not just the North, should be apprehensive about any form of reform, particularly taxation, coming from a regime that has demonstrated enormous bias in appointments, particularly in the Finance sectors of all federal establishments. A country of over 200 ethnic groups having one tribe that also has the President heading the Police, the DSS, the Army, and virtually all revenue points in Nigeria cannot come up with a reform that will not be challenged.

Nothing so far in the 19 months of Tinubu’s administration that will make Nigerians jump at any of his policies as having a national or patriotic touch, more so taxation, where the President had demonstrated some wizardry with his controversial Alpha Beta tax consulting group.

Also, meaning well and delivering well are two different things. If Tinubu means well in the tax reform, why not make efforts and deliver it well instead of pushing it aggressively enough to raise suspicion from bystanders?

One significant other side of this tax reform issue that has been brought out copiously, which Nigerians are not looking at critically, is the vertical division it exposed in Tinubu’s administration.

Number two citizen of this country, Vice President Kashim Shettima, has the constitutional mandate to head and preside over the National Economic Council, NEC, the highest statutory economic body of the government, this august body looked at the reform and recommended that it be withdrawn for now for further consultations, but he was ignored. That’s disrespectful from whichever angle you stand to look at it. As the highest Northerner in this system, the VP met with Northern governors who raised some apprehensions over the reform bill, and their advisories were discarded. No wonder the VP’s Senator Ali Ndume and his Governor Babagana Zulum are more pissed off and vocal against the reform. Even the appointment of the integrity challenged Daniel Bwala, who is from the VP's state as Presidential Adviser when it’s known that he is not on good terms with the VP also says a lot. Even if one does not agree with the North on certain aspects of their position on tax reform, the obvious disrespect to the office of the VP and the Northern governors is too daring and politically unwise.

Subjecting such critical things like the controversial tax reform to the National Assembly looks plausible since they are the people's representatives, but this 10th Assembly is beyond being just a rubber stamp; they are virtually a department in the Executive arm. They passed the new National Anthem without consulting anybody; they passed a private Jet purchase for the President without a single debate. Under their watch, the exact figures of the National budget are unknown; they approve loans, both local and foreign, without debate, all the President's nepotistic appointments are going on and they just look away.

Against this backdrop, Nigerians will find it difficult to jump at anything coming from the two arms, the Executive and the Legislature especially knowing too well by empirical evidence that the third arm, the judiciary is virtually non-existent being a member of the triumvirate and will gladly play along even if the People’s interest is at risk.

Therefore, the points highlighted above are responsible for the sparked intense discussions going on, and its fallout could have significant implications for the country's economy, politics, and social stability.

The proposed VAT increase could lead to further higher prices for goods and services, affecting low-income households disproportionately. Small businesses might struggle to comply with the new tax laws, potentially leading to business closures or reduced operations.

Politically, the tax reform debate has already flared regional tensions, with Northern leaders opposing the bill and this could lead to increased political polarization.

The controversy surrounding the tax reform bill could lead to legislative gridlock, making it challenging to pass other important bills, and above all, it has raised concerns about the Tinubu government's commitment to fairness and equity. On the social flank, the tax reform is going to further send more population into multidimensional poverty and may lead to further brain drain. (japaring)

The accompanying intrigue and the horse trading being witnessed in the debate have brought to the fore various interests and intrigues. It's also creating further division between the regions, raising constitutional issues about its infringements on the powers of state governments to collect taxes. This has led to concerns about the potential for legal challenges and conflicts between the federal and state governments. There are also fears that the reform tends to give more revenue power to the federal government, which is already enjoying an overdose of power and is rightly seen by many discerning minds as too overwhelming.

But all said and done, the citizens should be paramount, and this brings this conversation conclusively to Ronald Paul’s remarks that “One thing is clear: The Founding Fabthers never intended a nation where citizens would pay nearly half of everything they earn to the government.” And Chinese philosopher Lao Tzu notes that "The people are hungry because those in authority eat up too much in taxes"

God help us.