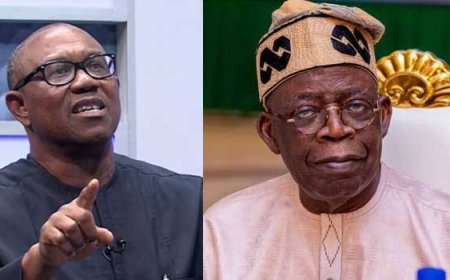

Tax Laws: Obi Lambasts Nigerian Government, Says Prosperity Cannot Come By Taxing Poverty

Former presidential candidate of the Labour Party in 2023, Peter Obi, has lampooned the Federal Government over it's newly introduced tax laws, noting that prosperity cannot be achieved by placing heavier burdens on poor citizens.

Former presidential candidate of the Labour Party in 2023, Peter Obi, has lampooned the Federal Government over it's newly introduced tax laws, noting that prosperity cannot be achieved by placing heavier burdens on poor citizens.

Obi, who also, served as governor of Anambra State defected to the African Democratic Congress, ADC, Wednesday, noting that transformative leadership was rooted in honesty.

Obi further noted that Nigeria’s current taxation framework fell short of these standards, stressing that taxation should operate as a genuine social contract between the government and the people.

He urged that governments must be transparent and truthful in order to earn citizens’ trust.

He spoke in a post on X on Friday, questioning the government’s approach to taxation, calling for transparency, fairness, and people-centred fiscal policies.

His words, “Prosperity cannot come by taxing poverty. As I travel around the world and meet leaders who have transformed their nations, one lesson is clear: lasting economic and social progress begins with national consensus.

“Government must be transparent and truthful because citizens deserve nothing less from those who lead them. True leaders do not exploit their people to enrich themselves and a few cronies; they build trust, unity, and shared purpose, the foundation of sustainable progress.

“If taxation is to function as a genuine social contract, it must be rooted in sincerity, fairness, and concern for the welfare of the people. Every tax policy should be clearly explained, including its impact on incomes and its expected contribution to national development.

“You cannot tax your way out of poverty, you must produce your way out of it,” even as thriving small businesses would naturally expand the tax base by creating jobs and increasing incomes.

According to him, Nigerians are being asked to pay taxes without adequate explanation or visible benefits, a situation he said undermines economic growth and national unity.

Obi also emphasised the importance of empowering small and medium-sized enterprises, noting that economic growth is driven by production rather than excessive taxation, just as he further expressed concern over what he described as an ongoing tax fraud controversy, alleging that the new tax laws were forged.

“For the first time in Nigeria’s history, a tax law has reportedly been forged. The National Assembly itself has admitted that the version gazetted is not what was passed into law,” he added.

Obi warned that citizens were being asked to pay higher taxes under a framework lacking transparency and legitimacy, even as he called for a fair, lawful, and people-centred tax system that supports enterprise, protects the vulnerable, and restores public trust.

No Debit, Narration

Meanwhile, the Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, has clarified misconceptions surrounding the new tax laws, stating that the reforms would not involve automatic debits from personal bank accounts.

According to Oyedele, individuals will also not be required to provide narrations or explanations for bank transfers, describing the reforms as simple and transparent.

President Bola Tinubu had also, reaffirmed that the implementation of the new tax laws would proceed as scheduled, despite criticisms from opposition figures, labour unions, and other political figures.

Tinubu said in a statement, that the reforms were not intended to increase taxes but to support a structural reset, promote harmonisation, protect citizens’ dignity, and strengthen the social contract.

“The new tax laws, including those that took effect on June 26, 2025, and the remaining acts scheduled to commence on January 1, 2026, will continue as planned,” Tinubu further said.

He described the reforms as “a once-in-a-generation opportunity to build a fair, competitive, and robust fiscal foundation for our country” and urged Nigerians to support their implementation.

The tax reforms, signed into law in June 2025, aim to simplify Nigeria’s tax system, broaden the tax base, and protect low-income earners and small businesses.

Key provisions include full personal income tax exemption for individuals earning ₦800,000 or less annually, while higher earners will be taxed at progressive rates capped at 25 per cent.

Small businesses with a turnover of less than ₦100 million are exempted from company income tax, value-added tax, and the newly introduced development levy. Corporate tax for larger firms has been reduced from 30 to 25 per cent.

Value-added tax remains at 7.5 per cent, with exemptions for essential goods and services, while revenue collection is to be centralised under the Nigeria Revenue Service.

Despite ongoing controversies and court challenges, the government has maintained that ordinary citizens will not face new tax burdens, noting that exemptions also apply to minimum wage earners, pensions, gifts, remittances, and diaspora Nigerians, pointing out that the reforms , are designed to ease tax pressures, support businesses, and promote a fairer and more transparent tax system capable of driving economic growth.

What's Your Reaction?